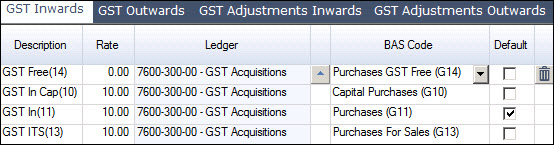

The standard set up for the Business Activity Statement (BAS) Codes is maintained using the Tax Configuration form. The form allows the GST rates to be entered and connected to the General Ledger. These rates are linked to the Business Activity Statement (BAS) codes for collation and reporting to the Taxation Office.

A new Jiwa database ships with GST Rates already set-up and these can be changed as required. Any changes to a rate that has been used on a form or adding new rates warns when saving the changes 'BAS codes have been modified. Changing the BAS Codes without ensuring all documents using the Tax Rate may cause incorrect figures to be reported on the BAS Report. Do you want to continue saving?'

Steps

Steps

|

1. |

System

|

|

2. |

Select the required tab -

|

|

3. |

Enter the Description, Rate, Ledger Account, BAS Code and default option |

| 4. | Save changes |

Copyright © 2012 Jiwa Financials. All rights reserved.